Understanding the Basics of Credit Scores: A Guide for Beginners

In today’s financial world, credit scores play a vital role in determining our financial health and opportunities. Whether you’re applying for a loan, a credit card, or even renting an apartment, your credit score will likely be evaluated. This guide aims to provide beginners with a comprehensive understanding of credit scores, their significance, and how they are calculated.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness. It is a three-digit number that summarizes a person’s credit history and helps lenders assess the risk of lending them money. The higher the credit score, the better the person’s creditworthiness.

Importance of Credit Scores

Credit scores have a significant impact on various aspects of our financial lives. They influence the interest rates we receive on loans, the credit limits on our credit cards, and even our ability to secure certain jobs or rental agreements. Therefore, it is crucial to understand how credit scores are calculated and how to maintain a healthy score.

Factors Affecting Credit Scores

Several factors contribute to the calculation of a credit score. The most influential factors include:

- Payment History: Your payment history accounts for about 35% of your credit score. Lenders want to see a consistent pattern of on-time payments.

- Credit Utilization: This factor makes up around 30% of your credit score. It reflects the percentage of available credit you’re using. It’s recommended to keep your credit utilization below 30% to maintain a good score.

- Length of Credit History: The length of your credit history makes up about 15% of your credit score. Lenders prefer longer credit histories as they provide more data for evaluation.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your score. This factor contributes about 10% to your credit score.

- New Credit Applications: Each time you apply for new credit, it can slightly lower your score. Avoid opening multiple new credit accounts within a short period.

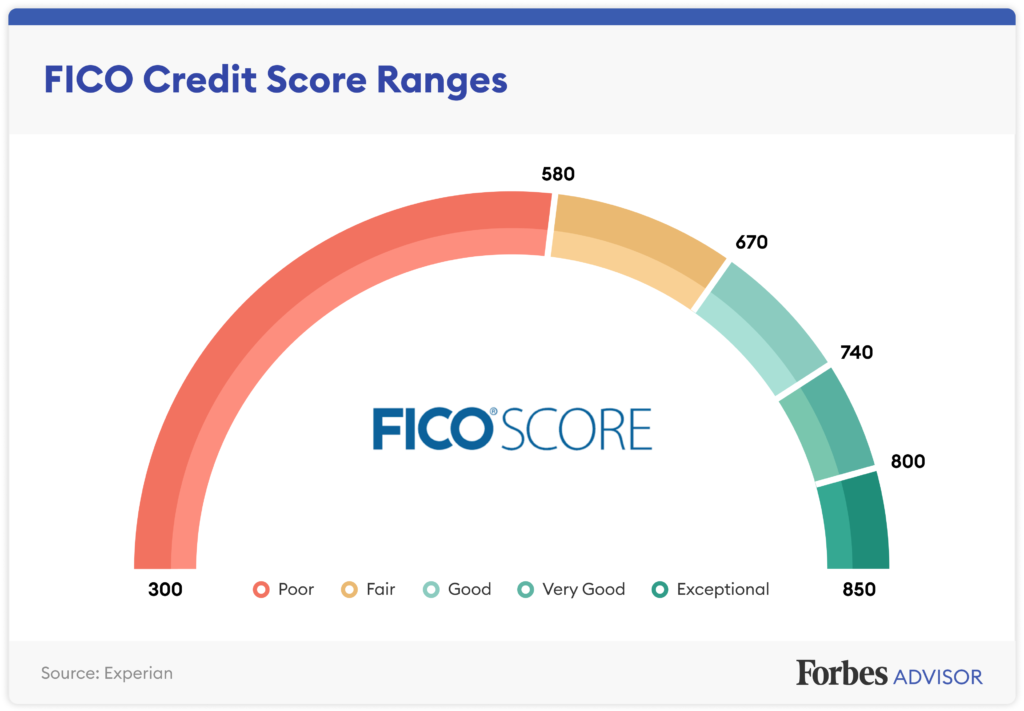

Understanding Credit Score Ranges

Credit scores fall within a range, typically between 300 and 850, with higher numbers indicating better creditworthiness. Here are the general ranges:

- Poor (300-579): Individuals in this range may face difficulties obtaining credit and may be subject to higher interest rates.

- Fair (580-669): While it’s possible to secure credit in this range, it may come with higher interest rates and less favorable terms.

- Good (670-739): This range signifies a solid credit score, increasing the likelihood of being approved for credit at reasonable rates.

- Very Good (740-799): Individuals in this range are considered low-risk borrowers, often qualifying for the best interest rates available.

- Excellent (800-850): This range represents an exceptional credit score, providing individuals with the most favorable terms and opportunities.

Improving and Maintaining a Good Credit Score

If you have a less-than-desirable credit score, don’t worry. There are steps you can take to improve and maintain it:

- Pay your bills on time: Late payments have a significant negative impact on your credit score, so prioritize timely payments.

- Reduce your credit card balances: Lowering your credit card balances can help improve your credit utilization ratio.

- Avoid opening unnecessary credit accounts: Applying for multiple credit accounts within a short period can lower your score. Only open new accounts when necessary.

- Monitor your credit reports: Regularly review your credit reports to check for errors or fraudulent activity. Dispute any inaccuracies you find.

- Maintain a long credit history: Keeping old credit accounts open, even if they have a zero balance, can positively impact your credit score.

Understanding credit scores is essential for financial well-being. By comprehending the factors that influence credit scores and adopting healthy credit habits, you can improve your creditworthiness over time. Remember, building a good credit score takes time and consistency, but the benefits are worth the effort. Stay proactive, monitor your credit, and make wise financial decisions to secure a bright financial future.